Today I will give you a quick overview of the long-term investment strategy in stocks that I’ve been applying successfully for over a decade. It’s a very simplified summary but will give you a good idea of how I’m doing things.

To begin with, my long-term investment strategy is passive (no active trading whatsoever). I usually check in to see what’s happening no more than once a month and buying is happening automatically using the dollar cost average effect.

- I only buy stocks/funds as there is always a high user interest.

- To choose the ones with a high probability for higher returns than the market average I look for those that outperform the index (benchmark). You can choose whichever index you prefer and then look for stocks/funds that are either based on or part of that index.

- Another criteria for me is that they have to be volatile. Volatility in this case is not a bad thing but will give you more opportunities to generate profits.

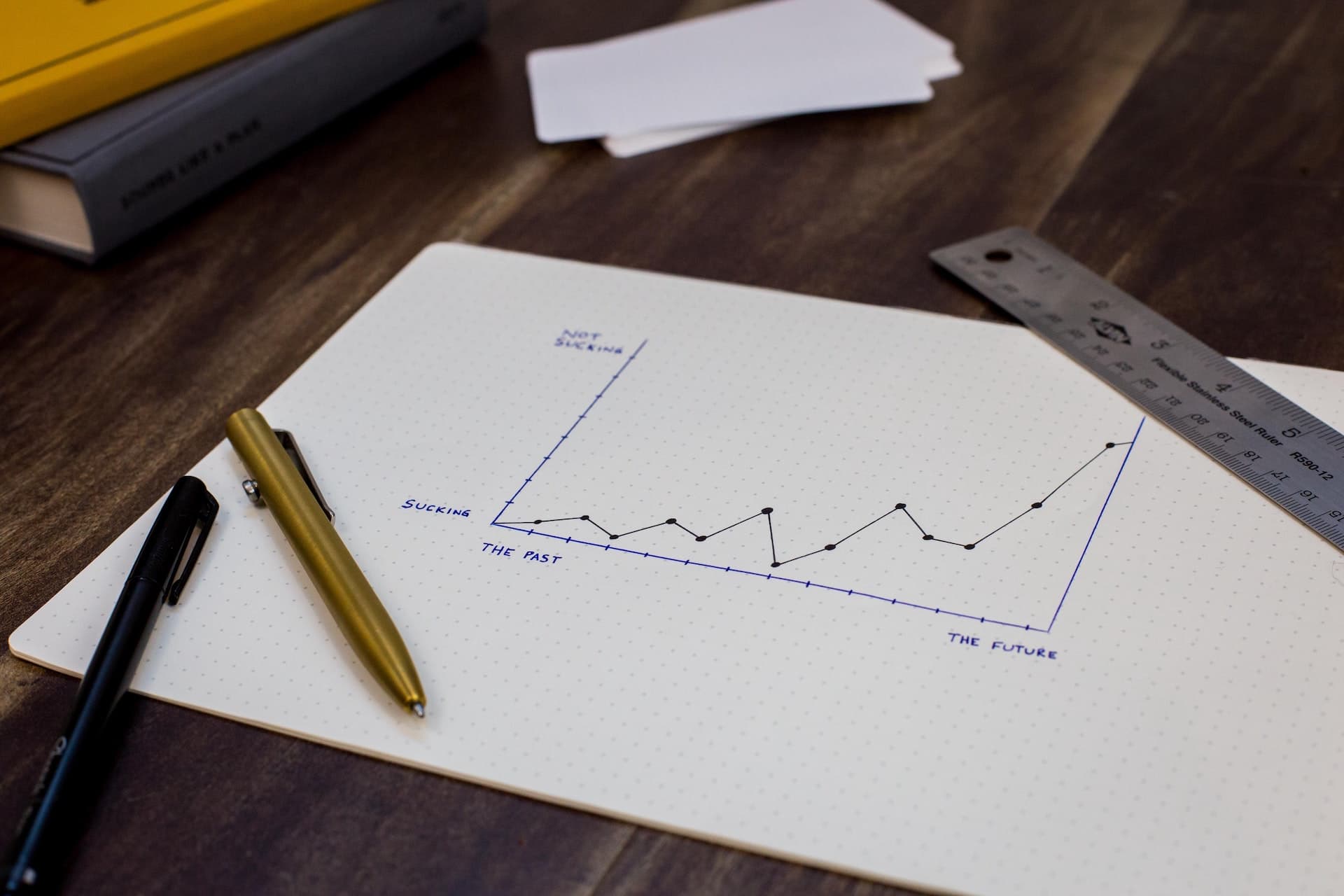

- Finally you’ve got to make sure to act completely emotionless when it comes to investing. It’s important that you trust the system and apply the strategy while keeping the emotions out.

Would you like to learn more? Check out The Nine Step Investment Plan to get started.

Watch full episode (use Chrome browser):